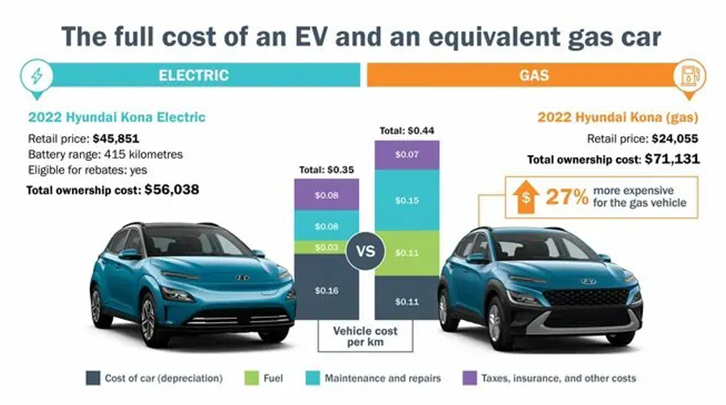

How Do Electric Cars Compare To Traditional Cars In 2024?

Electric vehicles (EVs) have surged to a dominant position, with forecasts suggesting they will account for over…

Electric vehicles (EVs) have surged to a dominant position, with forecasts suggesting they will account for over…

Every year, flying debris and minor collisions result in over 14 million damaged windshields in the United…

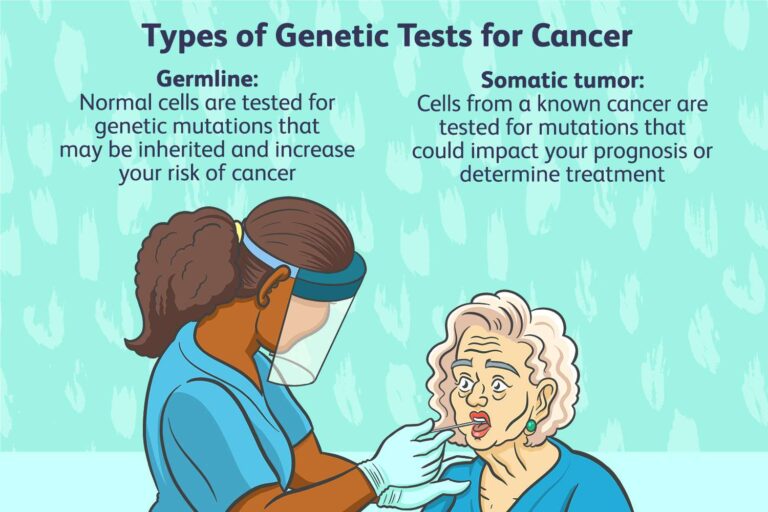

Unraveling the genetic blueprint holds insights into potential health threats, particularly cancer, which remains a daunting specter…

Could altering our daily routines hold the key to combating cancer? Research shows that lifestyle choices account…

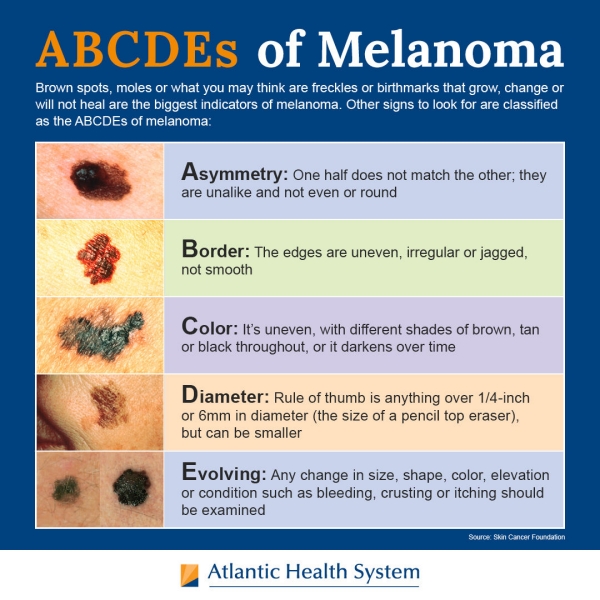

Have you ever considered how a tiny mole might harbor a deadly secret? Melanoma, a formidable type…

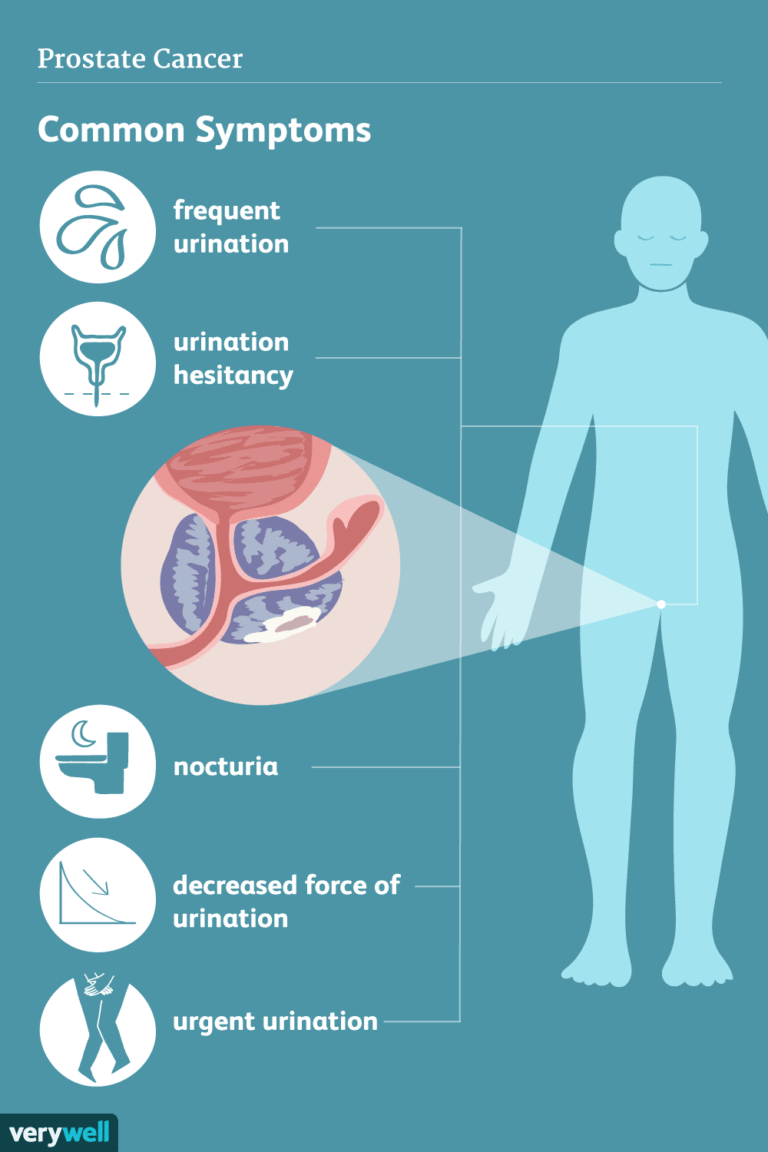

Amidst the spectrum of health challenges, one striking statistic stands out: prostate cancer is one of the…

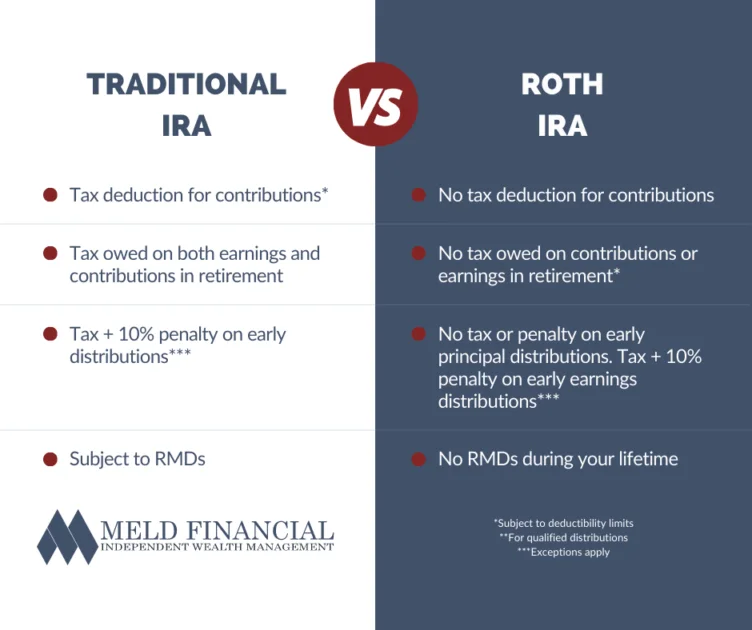

In the realm of retirement planning, the choice between Traditional and Roth IRAs often hinges on tax…

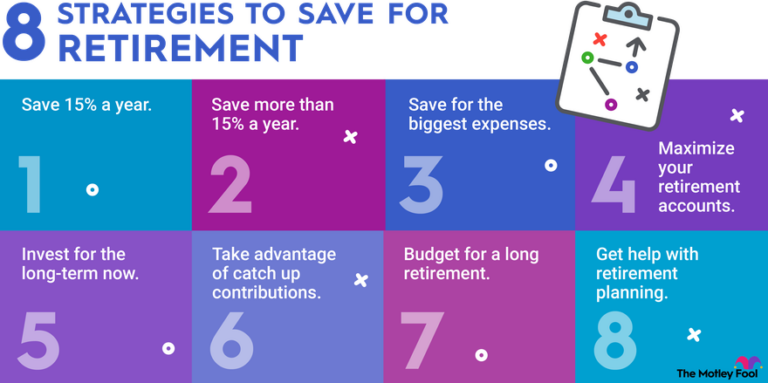

Interestingly, many people overlook that even small, consistent contributions to a retirement fund can accumulate significantly over…

In a world where travel experts frequently highlight the same hotspots, discovering hidden gems often feels like…