Why Is Travel Insurance Important?

Every year, thousands of travelers encounter unexpected mishaps, ranging from lost baggage to sudden medical emergencies. The reality is, even the most meticulously planned trips are prone to unforeseen challenges. Travel insurance stands as a safeguard, offering peace of mind in a world full of uncertainties.

The concept of travel insurance dates back to the early 19th century when travelers sought protection from mishaps during extended voyages. Today, its significance is more pronounced, with reports suggesting that insured travelers save thousands in emergency and medical expenses annually. Understanding this safety net ensures that you remain financially secure, regardless of where your journey takes you.

Why Is Travel Insurance Important?

Travel insurance is essential because it protects travelers from unexpected problems. Everyone loves to plan vacations, but things don’t always go as expected. You might get sick or injured in another country, and hospital bills can be expensive without insurance. Having travel insurance means you are covered in such situations. It helps provide peace of mind, knowing you’re prepared for emergencies.

Another reason travel insurance is crucial is that it covers trip cancellations. Imagine if you need to cancel a holiday due to an unforeseen event. Without insurance, you could lose the money spent on flights and hotels. Travel insurance reimburses these costs, ensuring that your finances are safe. This coverage is significant if your trip is costly or includes non-refundable bookings.

Luggage can get lost, damaged, or delayed, causing inconvenience during travel. Travel insurance helps manage these situations by covering costs related to lost belongings. It can provide funds for buying essential items while the airline retrieves your bags. In some cases, reimbursement for the belongings’ value is possible. So, insurance ensures you are not financially strained due to luggage issues.

Different policies offer various benefits based on your needs. Some plans focus on medical emergencies, while others cover a range of travel-related issues. When choosing travel insurance, it’s vital to compare different options. Check if the policy suits your travel plans and destinations. By selecting the right policy, you ensure comprehensive coverage for your journey.

Protection Against Unforeseen Medical Expenses

Travel insurance offers crucial protection against unforeseen medical expenses. While traveling, you might face unexpected health issues or injuries. Medical treatments can be costly, especially in foreign countries. Without insurance, paying these bills can drain your savings quickly. Travel insurance ensures that you receive necessary medical care without worrying about the cost.

Consider what would happen if you needed urgent medical attention during your trip. The expenses could include hospital stays, doctor visits, and medication. In extreme cases, medical evacuation might be necessary, which is incredibly expensive. A good travel insurance policy covers these costs, providing financial relief. This coverage allows you to focus on recovery rather than financial stress.

Not all insurance plans are the same, though. Some policies might offer extensive medical coverage, while others have limited options. Before purchasing a policy, individuals should carefully evaluate their needs. Consider factors such as destination, travel duration, and personal health conditions. Making an informed choice ensures comprehensive coverage tailored to your trip.

Having a policy with protection leads to a more secure travel experience. Travelers can enjoy their journey without constant worry about medical issues cropping up. Knowing that insurance has your back offers significant peace of mind. This confidence allows you to explore with ease, enhancing your travel experience. Ultimately, travel insurance acts as a safety net, letting you enjoy your adventures worry-free.

Impact of Travel Insurance on Financial Security during Travel

Travel insurance plays a vital role in protecting financial security while you’re on a trip. Unplanned expenses, such as medical emergencies or trip cancellations, can quickly deplete your savings. With travel insurance, these costs are covered, allowing you to keep your finances intact. This protection means you can travel with confidence, knowing you won’t face unexpected financial burdens. It provides a safety net that is essential for any traveler.

This type of insurance also prevents financial losses related to lost or stolen belongings. While traveling, your personal items may be misplaced or taken. Replacing them can be costly, especially when abroad. Travel insurance can reimburse you for lost items, easing the financial impact. This coverage ensures that you can continue your trip without added financial stress.

Price changes and unplanned events can also disrupt travel plans. For instance, a sudden increase in costs or a natural disaster may lead to trip cancellation. Insurance helps recover pre-paid costs related to transportation and accommodations. This feature is crucial for safeguarding your travel investment. It lets you plan your trips without fear of potential financial loss.

To maximize its benefits, choosing the right travel insurance policy is crucial. Policies vary in coverage and cost, so it is important to find one that suits your needs. Consider what coverage you might need based on your destination and activities. This preparation ensures that you are well-covered no matter what situation arises. With the right insurance, you can focus on enjoying your travels with complete peace of mind.

Travel Insurance: A Shield against Trip Cancellation and Interruption

Travel insurance acts as a vital shield against trip cancellation and interruption. Imagine planning the perfect vacation, only to cancel it last minute due to an unexpected event like illness or a family emergency. Without insurance, you could lose a significant amount of money on flights, hotels, and other bookings. Travel insurance reimburses these costs, allowing you to reschedule your plans without financial worry. It provides a comprehensive safety net for your travel investments.

Sometimes, trips can get interrupted halfway due to unforeseen situations such as severe weather or political unrest. In such cases, the expenses to return home or to extend your stay might increase suddenly. Travel insurance can cover these additional costs, ensuring you are not stranded. It guarantees that your trip disruption doesn’t become a financial nightmare. This provision is especially crucial for travelers venturing to areas prone to unexpected changes.

In some instances, travel agencies or airlines might face insolvency, leading to canceled services. Travel insurance protects you by covering non-refundable costs from these companies. Thus, it saves you from losing money due to events beyond your control. Having a reliable policy also means quicker refunds, so you can plan your next vacation sooner. This aspect makes travel insurance indispensable for frequent travelers.

Understanding what is covered under trip cancellation insurance is essential. Often, factors like illness, job loss, or jury duty are included but personal reasons may not be. Reviewing policy details ensures you’re aware of what circumstances are covered. Each policy differs, so choose one that matches possible risks related to your travel plans. This knowledge helps you make informed decisions, enhancing your travel experience.

The peace of mind travel insurance provides is invaluable. Knowing that your travel plans are protected from interruptions allows you to enjoy your journey fully. It offers security against the uncertainties that can arise before or during a trip. As you consider future travel, including insurance in your plans ensures a smoother, worry-free experience. Ultimately, it empowers you to take on new adventures confidently.

Roles of Travel Insurance in Lost or Delayed Baggage

Travel insurance plays a crucial role when dealing with lost or delayed baggage. Losing your bags can disrupt your trip and cause stress. Essential items like clothes, toiletries, and electronics might be inaccessible, leaving you unequipped. Travel insurance helps by covering the costs associated with buying necessary items until your luggage is returned. This financial support allows you to continue your trip with fewer worries.

When your baggage is delayed, waiting can be inconvenient and frustrating. Travel insurance often provides compensation for the delay, offering funds to purchase immediate essentials. This benefit is incredibly helpful, especially if the delay is long and in a remote location. Many policies offer a payout if bags are delayed for more than 12 hours. This prompt assistance ensures you can continue enjoying your trip despite the setback.

For lost luggage, the financial loss can be significant, especially if it contains valuable items. Insurance policies usually cover a portion of the item’s value, helping you to replace what’s lost. This coverage is based on either the actual value of the items or a pre-set limit in the policy. By understanding how this works, travelers can plan better and safeguard precious belongings. It promotes a practical approach to managing potential losses.

Filing a claim for lost or delayed baggage requires documentation. Travelers should keep baggage tags, airline tickets, and any receipts for items purchased due to the delay. Most insurance companies need this information to process claims smoothly. Knowing what information is needed in advance speeds up the claim process. Having this preparation in place makes dealing with baggage issues much easier.

Having travel insurance that considers these potential baggage issues is wise. It provides financial backup and reduces the stress of unexpected situations. Traveling becomes more enjoyable when you know you are protected against baggage problems. As you plan your next trip, keep in mind the importance of including such coverage. This consideration ensures a less stressful and more adaptable travel experience.

Types of Travel Insurance: Choosing What Suits Your Needs

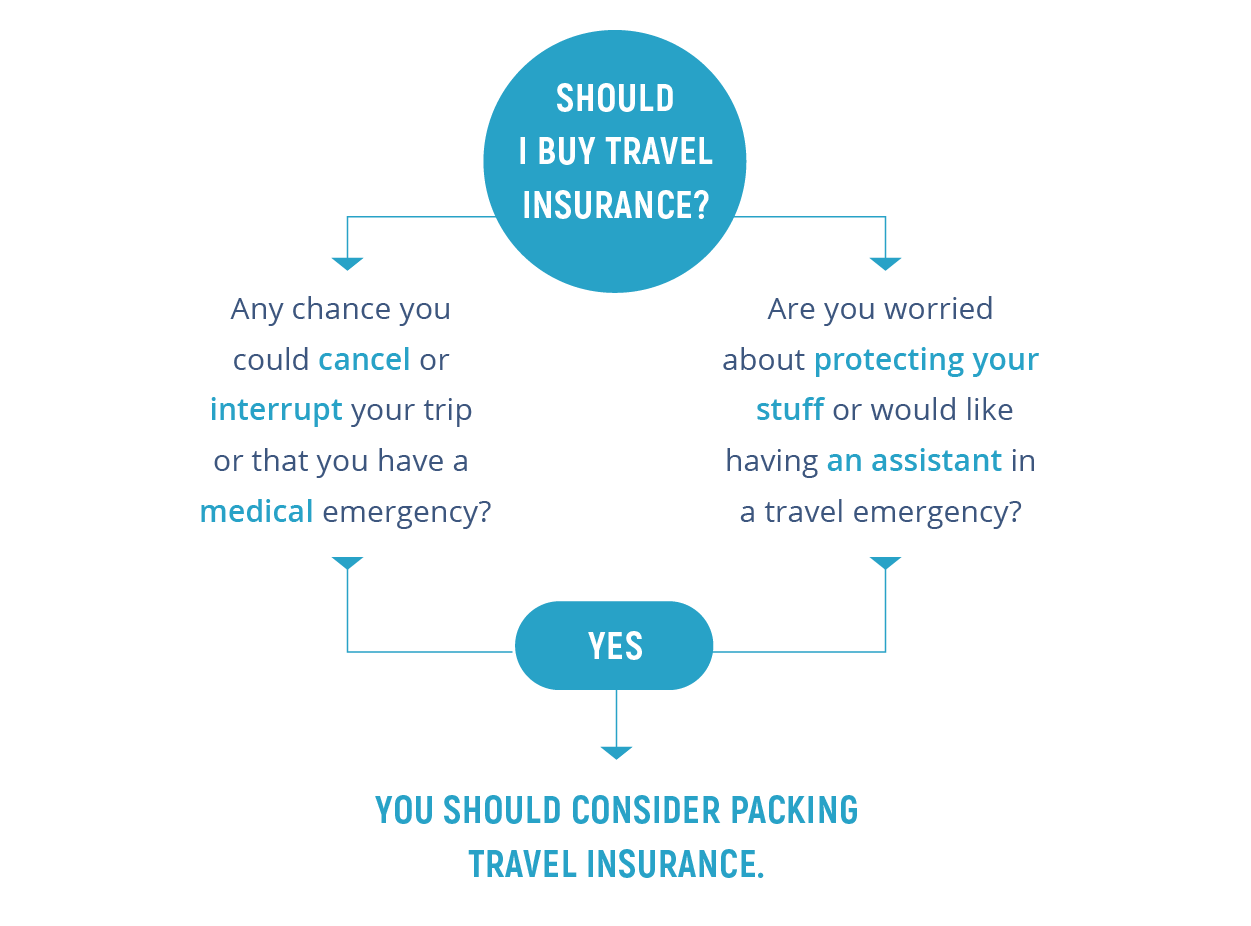

Choosing the right type of travel insurance depends on your trip and personal needs. There are various policies available, each catering to different aspects of travel. From trip cancellation to medical emergencies, picking the right coverage is crucial. Assessing your travel itinerary and potential risks helps in making an informed decision. The right choice ensures you are well-protected during your journey.

One common type is single-trip insurance, which is ideal for occasional travelers. It covers you for one specific trip, catering to basic needs like medical emergencies and lost baggage. This option is usually affordable and straightforward, perfect for quick vacations. However, if you travel frequently throughout the year, an annual multi-trip insurance might be more suitable. It provides coverage for multiple trips over a specific period, often resulting in cost savings.

For those venturing into adventure sports or activities, specialized insurance is necessary. Standard travel insurance may not cover high-risk activities such as skiing or diving. Ensuring you have the right coverage prevents issues should an accident occur during these adventures. This type of policy can include additional protection for equipment. Always check the specific activities and risks your policy covers before embarking on such trips.

- Medical Travel Insurance: Focuses solely on medical emergencies, providing comprehensive health coverage during travels.

- Family Travel Insurance: Provides coverage for families traveling together, often at a lower premium than purchasing individual policies for every member.

- Group Travel Insurance: Ideal for larger groups traveling together, offering collective coverage that can cater to shared risks and costs.

Understanding what each type of insurance covers helps in making the best choice. Be sure to read the fine print and ask questions about what is and isn’t included. Comparing different policies side-by-side can help highlight the best value for money. Ensure your plan matches the length and nature of your trip. This diligence ensures you are adequately covered for any eventuality.

Taking the time to select the right travel insurance adds confidence to your travel plans. It offers peace of mind knowing potential issues are covered. By carefully evaluating your options, you protect yourself from unforeseen circumstances. This careful planning assures a smoother and more enjoyable travel experience. Ultimately, the right travel insurance offers both security and freedom as you explore new destinations.

Frequently Asked Questions

Travel insurance is often a crucial part of any travel plan, protecting against unforeseen circumstances. Here are some common questions and answers to help you understand its importance better.

1. What does travel insurance typically cover?

Travel insurance is designed to cover a variety of unexpected events that can occur during trips. Common coverage includes medical emergencies, trip cancellations, flight delays, and lost luggage. Depending on the policy, some might also include emergency evacuations or adventure sports incidents, offering comprehensive protection.

Travelers can choose policies tailored to specific needs, ensuring coverage that suits the nature of their travel. It’s vital to read through policy details carefully to understand inclusions and exclusions, ensuring alignment with your travel activities and destinations.

2. How can travel insurance protect during a medical emergency abroad?

Medical emergencies abroad can be costly and overwhelming without insurance. Travel insurance provides coverage for medical treatments, hospital stays, and sometimes even medical evacuation back to your home country if necessary. This coverage ensures you receive proper care without financial strain.

In addition to financial coverage, insurance can also assist with finding medical facilities and contacting emergency services in a foreign country. This added support and guidance are invaluable, especially when language barriers or unfamiliar healthcare systems come into play.

3. Is there coverage for trip cancellations, and what does it include?

Trip cancellation is a common feature in travel insurance, protecting against unforeseen events that might disrupt your plans. Coverage typically includes cancellations due to personal emergencies, like illness or family tragedies, and sometimes weather-related disruptions. This feature helps recover non-refundable expenses, offering peace of mind.

Understanding the specific reasons covered by your policy is crucial, as not all cancellations may qualify. Reviewing the terms before purchase ensures clarity, making sure you’re well-prepared if cancellation becomes inevitable.

4. Can travel insurance be used for lost baggage?

Yes, travel insurance often covers lost baggage, offering compensation for the replacement of essential items. This coverage is useful when airlines misplace luggage, providing financial relief to buy necessary clothes and toiletries until your baggage is found or replaced.

While the reimbursement might not cover the full value of lost items, it alleviates the immediate inconvenience. Keeping baggage receipts and documentation during travel is essential for filing successful claims, ensuring you receive due compensation promptly.

5. What factors should be considered when choosing travel insurance?

When selecting travel insurance, consider your destination, trip duration, planned activities, and personal health needs. Each of these factors influences the type and level of coverage required. For instance, adventurous activities may demand specialized coverage not included in standard policies.

Comparing different insurance providers and reading customer reviews can provide insights into claim processes and customer service reliability. It’s important to balance premium costs with coverage quality, selecting a plan that offers both value and peace of mind for your travel specifics.

Conclusion

Travel insurance offers essential protection, acting as a buffer against the unpredictabilities of travel. It provides financial security for travelers, covering unexpected medical emergencies, trip interruptions, and lost baggage. By ensuring such comprehensive protection, travel insurance transforms daunting travel risks into manageable concerns.

Choosing the right travel insurance requires considering your specific travel needs and potential risks. Understanding coverage options and policy details ensures that each journey is backed by appropriate security. This proactive approach not only safeguards your travel investments but also enhances peace of mind, allowing for a truly enjoyable travel experience.