What Are The Most Common Mistakes In Tax Filing?

Across the maze of tax filing, even seasoned professionals can find themselves ensnared by unforeseen complications. Interestingly, nearly 20% of taxpayers make some form of error on their returns each year, according to IRS data. Such figures illuminate a basic yet complex landscape where precision is pivotal, and oversights can lead to significant financial repercussions.

A common misstep involves overlooking or misreporting taxable income. Missing the reporting of side income, such as gig or freelance work, is more prevalent in this digital age of rapidly evolving employment landscapes. To mitigate these issues, experts recommend maintaining meticulous records and utilizing comprehensive software solutions that cross-reference and validate entries automatically, streamlining the overall process.

What Are the Most Common Mistakes in Tax Filing?

Filing taxes might seem straightforward, but common mistakes can lead to issues. Many people forget to report all their income. This often happens when they receive side income from freelancing or gig work. It’s easy to miss small amounts, but they can add up. Keeping detailed records helps avoid this mistake.

Another common error is mishandling deductions. Taxpayers sometimes deduct expenses they aren’t eligible for. This can lead to audits or penalties. Always double-check your receipts and know what deductions you qualify for. Using tax software can simplify this process.

Simple math errors also cause problems during tax filing. Even a small mistake in addition or subtraction can alter your return. Taking your time and rechecking your work is crucial. Using calculators or tax software can minimize these errors. Accuracy is essential to avoid revising your return later.

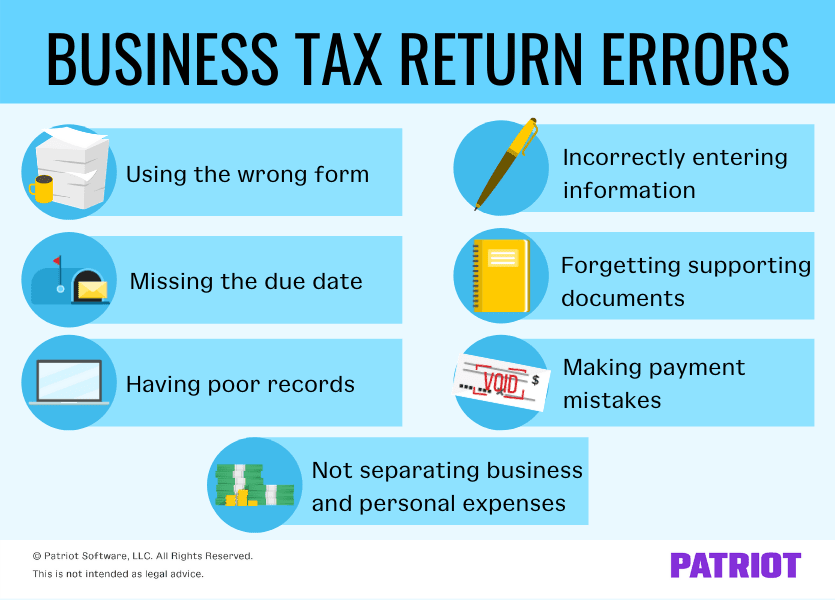

Missing deadlines is another frequent mistake that incurs unnecessary penalties. Tax returns typically must be filed by April 15th. It’s wise to mark your calendar or set a reminder. If you need more time, request an extension in advance. Staying organized ensures you won’t miss important dates.

Overlooking or Misreporting Taxable Income

Missing income on your tax return is a common mistake many people make. This often happens with side jobs or freelance work. Keeping track of all sources of income is crucial for accuracy. Even small gigs contribute to your taxable income. Utilize spreadsheets or apps to record every dollar earned.

Employers provide W-2 forms, but independent work often lacks clear documentation. This can cause confusion during tax season. To avoid this, maintain a file for all 1099 forms received. If a 1099 is missing, reach out to the payer immediately. Being proactive helps prevent errors on your return.

Misreporting income might seem negligible, but it can lead to serious issues. Sometimes, it results in penalties from the IRS. To avoid this, double-check your numbers before submission. Tax software often includes features that highlight discrepancies. This can be a valuable tool for ensuring accuracy.

If you ever realize you’ve made mistakes, don’t panic. Amendments can correct any misreported taxable income after the fact. IRS Form 1040-X is used to file changes. It’s better to fix errors than face future complications. Staying informed and organized ensures smoother tax seasons ahead.

Mishandling Deductions

Understanding tax deductions can be tricky. One of the biggest mistakes is claiming deductions you’re not entitled to. This happens when people misunderstand the rules. Keep in mind, not all expenses are deductible. Always double-check the eligibility of each deduction you intend to claim.

Home office deductions often lead to confusion. Many assume any work done at home qualifies, but that’s not true. Specific criteria must be met, such as exclusivity of space for work. Taking time to understand these rules is essential. You can find helpful guidelines on the IRS website.

- Medical expenses over 7.5% of your income

- Charitable donations with receipts

- Interest on student loans

Filing with software can help flag deduction issues. These programs often offer insights on common deduction errors. Regularly update your software to access the latest tax codes. Investing in a good tax preparation tool is a smart move. It reduces the chance of mishandling deductions on your return.

The Consequences of Common Tax Filing Errors

Filing taxes accurately is crucial because errors can bring costly consequences. One common result of mistakes is a delay in processing your tax return. This means any refund due to you will also be delayed. Correcting these errors takes additional time and effort. Always double-check your work before submission to avoid this hassle.

Another impact of tax filing errors is penalties. The IRS can impose fines for underreporting income or incorrect deductions. This can increase the amount you owe significantly. Interest on unpaid taxes may also accumulate. To minimize these risks, ensure every figure on your return is accurate.

Errors in filing can trigger an audit from the IRS. Audits can be stressful as they require providing detailed proof of income and expenses. Sometimes, they even lead to further investigation into previous years’ filings. While most people fear audits, maintaining organized records is the best defense. Good recordkeeping makes the audit process smoother, if it happens.

A table showing common errors and their consequences can be helpful:

| Error | Consequence |

|---|---|

| Underreporting Income | Penalties and interest |

| Mishandling Deductions | Fines and potential audit |

| Missing Deadlines | Late fees and added interest |

Lastly, tax errors can affect future financial planning. Inaccuracies today can cause complications in borrowing or credit assessments later. Banks often review tax returns when considering loan applications. Ensuring your taxes are correct helps you present a reliable financial history. Accuracy builds trust with financial institutions, opening up more opportunities in the long run.

How to Avoid Mistakes in Tax Filing

One effective way to avoid tax filing errors is by organizing all your documents. Keep track of all income statements and receipts throughout the year. Use folders or digital tools to categorize them by type. Having everything in one place makes it easier when you’re ready to file. Preparation is the key to a smooth tax season.

Double-checking your return before submission can prevent many errors. Many mistakes happen simply because people are in a rush to finish. Take a few extra moments to review your figures. Look for common errors like incorrect Social Security numbers or math mistakes. Catching these early reduces the chances of complications later.

Using reputable tax software is also beneficial. These programs often have built-in checks that identify potential issues. They guide you step by step through your return, ensuring you don’t miss anything important. Investing in good software saves time and stress. Plus, they get updated with the latest tax laws and regulations.

- File early to avoid the last-minute rush

- Consult a tax professional if needed

- Stay informed about tax law changes

Seeking professional guidance is another smart option. Complex tax situations might require expertise beyond what software can offer. A tax advisor can provide insights and identify eligible deductions you might miss. While it may cost more upfront, the investment can lead to savings and peace of mind. Consider consulting a professional, especially if your financial situation is complicated.

Finally, remember to be proactive about learning. Familiarize yourself with basic tax rules and changes each year. Websites like the IRS provide valuable resources and updates. The more informed you are, the better equipped you’ll be to file successfully. Knowledge is a powerful tool in avoiding tax mistakes.

Professional Tips to Simplify Tax Filing

Staying organized throughout the year can transform your tax filing experience. Start by creating a detailed checklist of documents and deductions. This checklist ensures you don’t forget anything crucial when tax season arrives. It also reduces stress by making you feel prepared. Keeping this list updated with any changes from tax laws is essential.

Consider setting aside a specific time each month for tax-related tasks. Use this time to update your records and organize receipts. Regular updates prevent last-minute chaos during filing season. Breaking down tasks into monthly goals makes the workload more manageable. Consistency is key to maintaining order.

- Automate savings for tax payments

- Use cloud storage for digital receipts

- Label documents clearly with dates and descriptions

Leverage digital solutions to further streamline the process. Tax software and apps can automate much of your data entry work. Many solutions offer mobile apps for tracking expenses on the go. This technology makes capturing deductions easier than ever. Knowing your tools can save significant time and effort.

Consult professional tax preparers if you encounter complex situations. Professional advice can be invaluable and reduce costly mistakes. They stay updated with evolving tax laws and offer personalized strategies. This guidance can help maximize your deductions and minimize tax liabilities. Building a relationship with a trusted tax professional ensures expert advice is always within reach.

Frequently Asked Questions

Taxes can be complex and sometimes overwhelming. Understanding common concerns can help streamline the filing process and avoid mistakes.

1. What documents do I need for tax filing?

Gathering the right tax documents is crucial for an accurate filing. These typically include forms like W-2 for employment income and 1099 for other earnings, such as freelance work or bank interest. Keeping receipts, especially for deductible expenses, can simplify the process and validate claims if needed. It’s smart to store these papers in a dedicated folder throughout the year.

In addition, documents related to education expenses, such as Form 1098-T, and health care coverage, like Form 1095-A, might be required. Consulting a tax advisor or using tax software can provide personalized checklists based on your situation. This ensures you’re equipped with everything necessary for a seamless and accurate tax submission.

2. How long should I keep tax records?

It’s wise to keep your tax records for at least three years from the date you filed your original return. This period is usually enough if the IRS decides to audit your filing. However, if you underreport your income by more than 25%, this period extends to six years, so retaining documents longer is beneficial in such cases.

For claims such as bad debt deductions or worthless security, you should keep records for at least seven years. Digital storage solutions can conserve space and make it easy to access past returns when needed. Maintaining accurate records ensures you have documentation ready if any questions arise regarding your tax history.

3. Can I file taxes electronically?

Yes, filing taxes electronically is now a widely available and encouraged option known as e-filing. E-filing can speed up the process of receiving your tax refund, often providing quicker returns than traditional paper filing. It tends to reduce errors since the software checks your data before submission, minimizing the chance of simple mistakes.

E-filing is also environmentally friendly, reducing paper usage significantly. Many IRS-approved providers offer free e-filing for those who meet certain income criteria. Additionally, electronic filing ensures a secure transfer of your information and offers immediate confirmation when the IRS accepts your return.

4. How can I maximize my tax refund?

To maximize your refund, ensure that you claim every eligible tax credit and deduction. Credits, such as the Earned Income Tax Credit, can increase refunds significantly. Keep good records of deductible expenses, like charitable donations, to support your claims. Using tax software can help identify credits and deductions you may overlook.

Filing early and being organized can prevent mistakes that reduce refunds. Double-check your entries for accuracy, especially income figures and Social Security numbers. Consulting a tax professional supports optimizing your tax situation, ensuring you’re receiving the fullest refund possible.

5. What should I do if I make a mistake on my tax return?

If you realize you’ve made an error on your tax return after submission, you can file an amended return using IRS Form 1040-X. This form lets you correct mistakes and must be mailed since electronic filing isn’t available for amended returns. Aim to correct errors promptly to minimize potential penalties or interest.

Review your original return to understand what needs correcting before submitting the amended version. Ensure that all changes are accompanied by supporting documentation. Keeping organized records will ease the process, and consulting a tax advisor can provide additional guidance on the best course of action for corrections.

Conclusion

Navigating the tax filing process requires attention to detail and proactive preparation. By understanding common pitfalls, such as misreporting income or mishandling deductions, individuals can effectively avoid costly mistakes. Utilizing professional tips, staying informed, and leveraging technology further streamline the experience, promoting more accurate filings.

Ultimately, the key to successful tax filing lies in diligent organization and timely action. Being well-prepared not only ensures compliance but also enhances financial outcomes. As tax laws evolve, maintaining a proactive approach will continue to be essential for expert taxpayers.