How Do You Save For Retirement On A Limited Budget?

Interestingly, many people overlook that even small, consistent contributions to a retirement fund can accumulate significantly over time. An anecdote from a teacher on a modest salary reveals how setting aside even $50 a month can grow to a substantial nest egg. Remember, starting early, no matter how limited the budget, can leverage compound interest to your advantage.

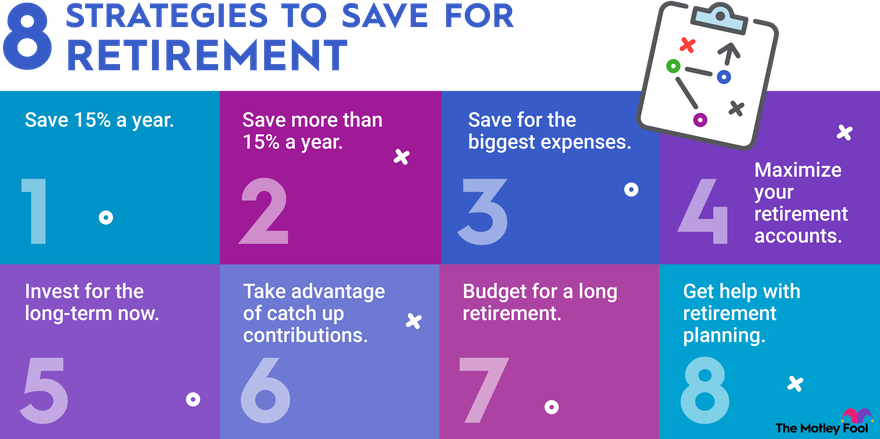

Historically, retirement savings were considered a luxury rather than a necessity for those on limited incomes. However, new insights highlight strategies such as automatic transfers and leveraging employer-sponsored plans to maximize contributions. Statistics show that individuals who consistently save small amounts can retire comfortably, defying the conventional emphasis on large savings.

How Do You Save for Retirement on a Limited Budget?

Saving for retirement on a tight budget can seem daunting, but it’s entirely possible with some planning. Even small amounts add up over time thanks to compound interest. Starting early gives savings more time to grow. Automating savings can help, making contributions a habit you hardly notice. Setting a realistic goal and sticking to it is key.

Understanding where your money goes each month can reveal opportunities for savings. Try creating a budget that includes saving as a priority. Reducing unnecessary expenses frees up more funds to put towards retirement. Every dollar saved is a step closer to financial security. Cutting back on things like dining out or entertainment can make a noticeable difference.

Many employers offer retirement plans that include matching contributions. Participating in such plans can significantly boost your savings. This is essentially free money added to your retirement fund. It’s wise to contribute enough to take full advantage of any employer match. Not doing so may leave money on the table.

Besides employer plans, personal savings accounts like IRAs offer tax advantages. These can make saving more attractive and financially beneficial. Comparing different options helps you choose the one that suits your situation best. Consider talking with a financial advisor for tailored advice. Planning strategically ensures maximizing use of available resources.

Importance of Starting Early

Starting early with retirement savings can make a huge difference over time. The power of compound interest means your money earns money. This can lead to exponential growth in savings. For instance, saving just a little each month can turn into a significant sum over decades. Even small contributions grow to large amounts.

Starting early also helps create a steady habit of saving. It becomes part of your routine, just like paying bills. This discipline can prevent future stress about finances. You become more prepared for life’s unexpected expenses. A good habit now leads to a secure future.

To see the benefits of starting early, consider this table:

| Age Started | Monthly Saving | Total at Age 65 |

|---|---|---|

| 25 | $100 | $254,000 |

| 35 | $100 | $120,000 |

The table shows how beginning at different ages impacts the total saved. The sooner you begin, the more you could potentially save. Time is your ally when it comes to building wealth. Early starters may not need to save as much each month later on. This gives more flexibility and less pressure as retirement approaches.

Utilizing Automatic Transfers

Automatic transfers can simplify your savings process by moving money without you even thinking about it. Setting up these transfers ensures that you consistently contribute to your retirement fund. It’s like paying yourself first before any other expenses come up. This method helps in building savings steadily over time. Consistency is key to reaching your financial goals.

Using automatic transfers means you don’t need to remember to save. The process is set up to occur regularly, like each payday. This reduces the temptation to spend the money elsewhere. It takes human error and forgetfulness out of the equation. This reliable system assures that your savings plan stays on track.

Consider these perks of using automatic transfers:

- Simplifies the saving process.

- Ensures consistent contributions to savings.

- Automates and removes the hassle of manual transfers.

- Helps avoid temptation to divert funds.

Many banks offer the service of setting up automatic transfers, and it’s usually easy to initiate. You can decide how much money to transfer and how often. Checking with your bank will provide specific details on how to get started. This convenience makes the daunting task of saving much easier. Using tools banks offer can be greatly beneficial long-term.

Maximizing Employer-Sponsored Plans

Taking full advantage of employer-sponsored plans can significantly enhance your retirement savings. Many employers offer matching contributions, which means they add money to your retirement account based on your own contributions. This is essentially free money. Ensuring that you contribute enough to get the full match should be a top priority. It’s a smart strategy to increase savings without additional effort.

Understanding your plan options is crucial to maximizing benefits. Some employers offer 401(k) plans, while others might provide 403(b) plans. Both come with perks like tax advantages and potential employer matches. Investigating the specifics of your plan allows you to make informed decisions. Knowing details helps you tailor contributions effectively.

There are various ways to maximize your employer-sponsored plan:

- Contribute enough to receive the full employer match.

- Review plan fees and choose low-cost investments.

- Consider increasing contributions as your salary rises.

- Keep track of your account and adjust as needed.

Increasing your contributions over time can boost your retirement fund even more. As you receive raises or bonuses, channeling some of that extra cash into your retirement plan can be advantageous. This incremental increase won’t feel as impactful on your budget. Yet, it dramatically impacts your retirement balance. Slowly adjusting contributions makes a big difference.

Ensuring that you are aware of any vesting schedules associated with employer contributions is equally important. Vesting refers to the period you must work before you can claim the full amount of matched contributions. Keep an eye on these timelines to avoid losing out on employer funds. This ensures you maximize the employer’s investment in your retirement. Always consult your HR department if you have questions.

Shattering the Myth: Retirement Savings as a Luxury

Many believe that saving for retirement is a luxury only the wealthy can afford. This myth prevents countless individuals from starting their savings journey. However, saving is essential, no matter the income level. Even with a modest income, consistent savings can grow significantly. The key is to start with whatever amount you can manage.

Interestingly, history shows that ordinary people can retire comfortably with smart savings strategies. It’s not about how much you earn but how much you save over time. Small contributions grow into large sums thanks to compound interest. Planning, rather than paycheck size, determines retirement security. Financial planning tools are accessible to everyone now more than ever.

To illustrate, here’s a list of actions that can help debunk this myth:

- Review your budget and identify areas to cut back.

- Open a savings account with no minimum balance.

- Automate monthly savings transfers, no matter how small.

- Engage with community or employer-sponsored savings workshops.

Breaking down this myth also involves changing perceptions. Retirement savings should be seen as a necessary expense like rent or food. Prioritizing it as mandatory can create a mindset shift. The earlier this change occurs, the better prepared you’ll be. Emphasizing education around this topic helps challenge long-held beliefs.

Community resources and support can empower more people. Workshops, online courses, and even free community classes offer guidance. Knowing where to get advice can be a game-changer. By leveraging these resources, individuals can create a feasible plan. A supportive environment can make all the difference.

Success Stories: Achieving Comfortable Retirement with Limited Savings

Many people have proven that comfortable retirement is possible even with limited savings. Take Jane, a librarian, who saved diligently by setting aside $50 each month for 30 years. By living modestly and prioritizing her savings, she was able to retire comfortably. Her story shows that it’s not the amount but the consistency that counts. Small, regular contributions can add up to substantial savings.

Another inspiring story is of Tom, a factory worker, who started saving in his 40s. Using his employer’s 401(k) plan, he contributed just enough to get the company match. This strategy significantly boosted his retirement fund over two decades. Tom’s approach highlights the importance of using employer-sponsored plans. Even starting later in life can yield positive results.

Consider these components of successful savings stories:

- Consistent monthly savings, no matter how small.

- Leveraging employer benefits like matching funds.

- Living below one’s means to increase savings potential.

- Starting with a financial plan tailored to personal needs.

Helen, a school teacher, used community workshops to gain financial knowledge. These workshops provided her with the tools to invest wisely in low-cost index funds. Her disciplined approach and use of available resources allowed her to retire at 65 easily. Helen’s story underscores the value of financial education. Having the right knowledge can lead to smarter financial decisions.

These success stories demonstrate that the right strategies and mindset can lead to a comfortable retirement. They show how individuals from various walks of life, with different financial backgrounds, achieved their retirement goals through discipline and planning. Inspiration can be drawn from their journeys. By following similar principles, others can set the path towards their own successful retirement.

Frequently Asked Questions

Understanding how to save for retirement, especially on a tight budget, can be overwhelming. Here are some common questions to help simplify this important financial goal.

1. What are the benefits of starting retirement savings early?

Beginning your retirement savings early allows you to take advantage of compound interest. This means your money grows over time, with the interest earning its own interest, leading to potentially larger savings down the road. Additionally, starting early allows for smaller contributions, making saving more manageable.

Early starters also have more flexibility and time to adjust their savings strategies as their financial situation changes. If unexpected expenses arise, having started early can provide more leeway in catching up later. Overall, the earlier you begin, the longer your money has to work for you, increasing your financial security.

2. How can automatic transfers help with saving for retirement?

Automatic transfers simplify the savings process by automatically moving funds from your checking to your savings or retirement account. This ensures consistent contributions without extra effort. By prioritizing savings through automation, you can avoid the temptation to spend instead.

Moreover, establishing this habit takes the guesswork out of when and how much to save. Automating your transfers builds a disciplined approach to saving, helping reach your long-term financial goals more effortlessly. It effectively turns saving into a part of your monthly routine.

3. Why is it important to maximize employer-sponsored retirement plans?

Employer-sponsored retirement plans often come with benefits like matching contributions, which effectively provide free money added to your savings. Maximizing these contributions ensures that you take full advantage of what your employer is offering. This can significantly boost your retirement fund over time.

Furthermore, these plans typically offer tax advantages, either deferred or immediate savings. By increasing your contributions, especially to the match level, you enhance your financial security. Leveraging employer benefits can create a more substantial foundation for retirement.

4. What role does budgeting play in saving for retirement?

Budgeting is key to understanding where your money goes each month and identifying areas to cut back. Creating and sticking to a budget ensures you set aside funds specifically for retirement savings. This prioritization helps you maintain a consistent contribution rate, vital for long-term success.

Knowing your spending habits also helps prevent overspending and can highlight expenses that are not essential. With a clear budget, every dollar can be allocated purposefully, enabling you to steadily grow your retirement nest egg. A structured budget reflects commitment to financial goals.

5. How can lifestyle changes contribute to retirement savings?

Lifestyle changes, like reducing unnecessary expenses or finding additional sources of income, can greatly impact your ability to save for retirement. Small adjustments, like cooking at home rather than dining out, can free up significant funds for savings. Prioritizing needs over wants builds a foundation for future security.

Additionally, embracing frugality and mindful spending reduces financial stress and allows more resources to be directed towards your retirement goals. Each change strengthens your savings potential. These habits, although small, culminate in a more comfortable and secure retirement.

Conclusion

Saving for retirement on a limited budget is not only achievable but also essential. By starting early, leveraging automatic transfers, and maximizing employer-sponsored plans, one lays a strong foundation. It requires discipline and smart planning, but the results lead to financial security in later years.

Adopting consistent saving habits and prioritizing retirement as a necessity rather than a luxury can significantly impact one’s financial future. Small, steady changes in daily expenses can accumulate into larger savings over time. Ultimately, proactive planning allows for a more comfortable and fulfilling retirement, regardless of income size.